PEPE Price Prediction: Technical Weakness and Bearish Sentiment Suggest Limited Upside Potential

#PEPE

- PEPE trades below 20-day MA at $0.00001099, indicating bearish technical momentum

- MACD shows weakening bullish momentum despite positive readings

- Negative news sentiment regarding volume, whale support, and competitive threats

PEPE Price Prediction

Technical Analysis: PEPE Shows Bearish Signals Below Key Moving Average

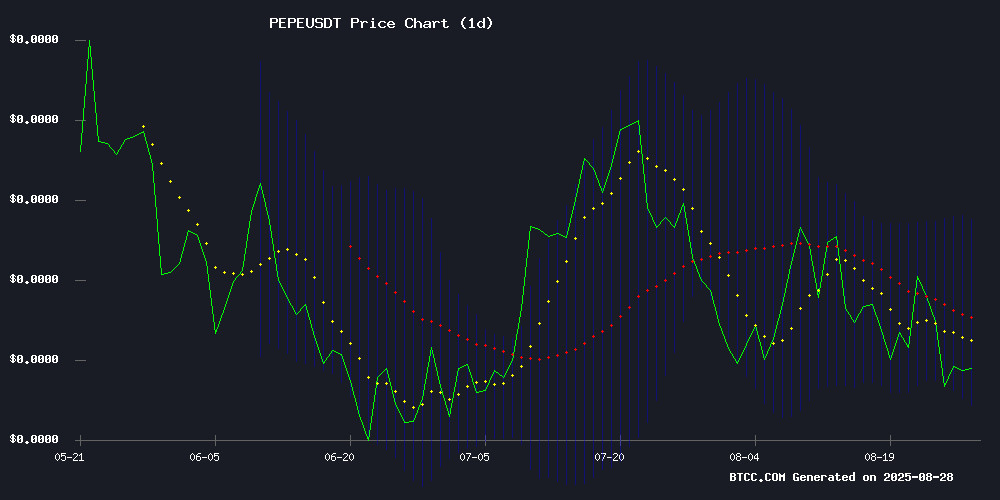

According to BTCC financial analyst John, Pepe is currently trading at $0.00001005, significantly below its 20-day moving average of $0.00001099. The MACD indicator shows a positive reading of 0.00000067, with the signal line at 0.00000039 and histogram at 0.00000028, indicating some bullish momentum but weakening strength. The Bollinger Bands position the current price near the lower band at $0.00000944, suggesting potential oversold conditions. The upper band resistance sits at $0.00001253, while the middle band aligns with the 20-day MA.

Market Sentiment: Bearish Headwinds Challenge PEPE's Recovery

BTCC financial analyst John notes that recent news flow presents significant challenges for PEPE. Headlines highlight evaporating trading volume, emerging competition from PEPE Dollar ($PEPD) in the presale market, and waning whale support alongside bearish derivatives positioning. These factors collectively suggest deteriorating market sentiment that aligns with the technical picture showing price struggling below key moving averages.

Factors Influencing PEPE's Price

Pepe Price Prediction: Meme Coin Faces Existential Threat as Volume Evaporates

Pepe (PEPE) has become the worst performer among top meme coins this week, sliding 2.3% as trader abandonment accelerates. The token's daily trading volume has remained below critical thresholds for two consecutive days - a classic bearish signal that often precedes deeper declines.

Futures market activity paints an equally grim picture. CoinGlass data reveals a 73% collapse in Pepe derivatives volume since July's $5 billion peak, when prices hovered near $0.000012. This liquidity exodus suggests traders are rotating capital into smaller-cap assets with greater upside potential during the current bull cycle.

Technical analysis shows PEPE breaking downward from a symmetrical triangle pattern, with $0.0000090 emerging as the next likely support level. The pattern typically signals market indecision before resolution - in this case, the breakdown points to a potential 39% depreciation ahead. While the $0.000010 psychological level may trigger temporary buying interest, the overall momentum remains decisively bearish.

Pepe Dollar ($PEPD) Gains Traction as BlockDAG Rival in Competitive Presale Market

The cryptocurrency presale arena is witnessing intensified competition as Pepe Dollar ($PEPD) emerges as a formidable challenger to BlockDAG. Combining meme culture with utility in payments and gaming, PEPD has raised over $1.76 million in its second presale stage, attracting investors with its structured pricing model and capped supply.

Market dynamics underscore a shift toward presale tokens with clear tokenomics, as seen in PEPD's rapid uptake. The project's blend of viral branding and functional design positions it among the top crypto presales of 2025, offering instant profits on entry—a key draw for the BlockDAG community now diversifying into PEPD.

Pepe Faces Downside Risk as Whale Support Wanes and Derivatives Turn Bearish

Pepe (PEPE) slid nearly 10% on Monday, breaching the critical $0.00001000 psychological level as bearish momentum intensified. Derivatives data reveals a concerning shift—open interest dropped 8% while funding rates turned negative, signaling overwhelming sell-side pressure.

On-chain metrics paint a similarly bleak picture. The number of large PEPE holders (100M-1B tokens) has dwindled to 41,058 from August's high of 41,506, while whale addresses holding over 1B PEPE fell to 9,725 from 9,815. This exodus coincides with a two-month low in profitable supply—just 37.63% of tokens now trade above their acquisition price.

Tuesday's meager 1% rebound offers little consolation. The meme coin's technical breakdown, compounded by eroding whale support and derivatives weakness, suggests further downside looms. Market participants appear to be voting with their feet—liquidating positions rather than defending key levels.

How High Will PEPE Price Go?

Based on current technical indicators and market sentiment, PEPE faces significant resistance near the $0.00001253 level (Bollinger Upper Band). The combination of price trading below the 20-day MA, bearish news flow regarding volume erosion and whale support withdrawal, and competitive pressures from new meme coins suggests limited near-term upside potential.

| Resistance Level | Price (USDT) | Significance |

|---|---|---|

| Upper Bollinger Band | 0.00001253 | Strong Resistance |

| 20-Day Moving Average | 0.00001099 | Key Technical Level |

| Current Price | 0.00001005 | Support Testing |

| Lower Bollinger Band | 0.00000944 | Critical Support |